GST Registration

₹3,000.00 ₹2,000.00

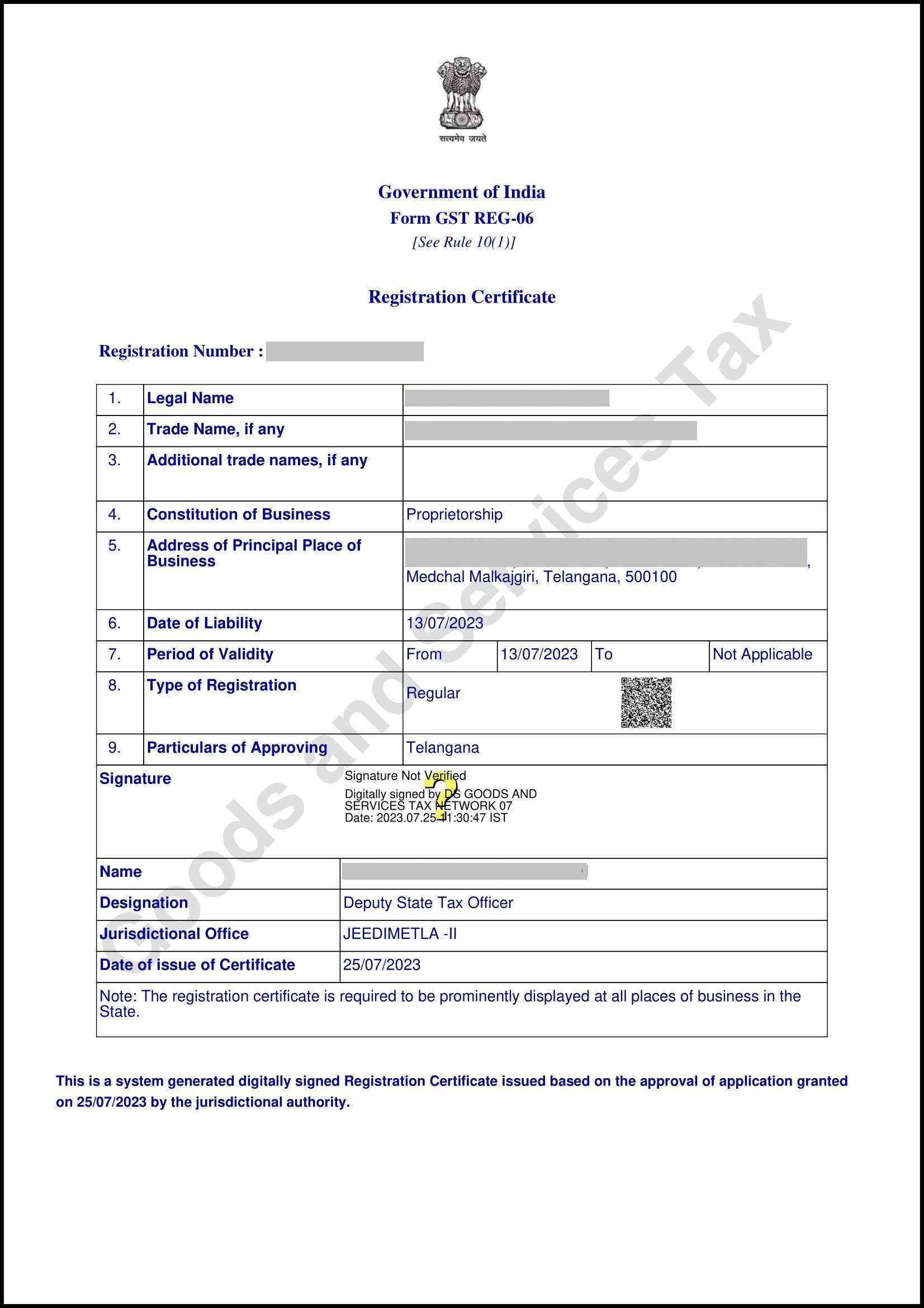

Discover everything you need to know about GST registration services in Telangana — from process, documents, costs, and compliance tips to expert insights, real-life examples, pros & cons, and FAQs. The ultimate guide for businesses, freelancers, and startups in 2025.

GST Registration Services in Telangana.

Running a business in Telangana? Whether you are starting a small shop, managing an e-commerce store, or expanding your manufacturing unit, GST Registration services in Telangana are essential for ensuring legal compliance and building customer trust.

At Invention Tax Solutions, we simplify the GST registration process so you can focus on growing your business without worrying about paperwork, penalties, or missed deadlines.

Why GST Registration is Important for Businesses in Telangana

Getting a GST number is not just about fulfilling a legal requirement—it’s a smart business move. Here’s why it matters:

-

Legal Compliance: Avoid penalties and fines by staying GST-compliant.

-

Boost Credibility: Customers and suppliers prefer working with GST-registered businesses.

-

Tax Benefits: Claim Input Tax Credit (ITC) and reduce your overall tax liability.

-

Business Expansion: Necessary for selling online, inter-state trade, and export-import.

-

Competitive Advantage: Stand out from unregistered competitors.

Who Needs GST Registration in Telangana?

You must apply for GST registration if:

-

Your annual turnover exceeds the prescribed threshold limit (₹40 lakhs for goods, ₹20 lakhs for services).

-

You sell goods or services online through platforms like Amazon, Flipkart, or Zomato.

-

You are involved in inter-state business transactions.

-

You run an e-commerce, manufacturing, or service-based business.

-

You supply goods or services to other states or countries.

Documents Required for GST Registration in Telangana

We ensure you have all the necessary documents ready before starting the process:

-

PAN Card of the business or proprietor.

-

Aadhaar Card of the owner/partners/directors.

-

Proof of Business Address (electricity bill, rent agreement, etc.).

-

Bank Account Proof (cancelled cheque or bank statement).

-

Business Registration Proof (Partnership deed, Incorporation Certificate, etc.).

-

Digital Signature Certificate (DSC) for companies and LLPs.

Our GST Registration Process

At Invention Tax Solutions, we follow a simple and transparent process:

-

Free Consultation: Understand your business type and GST requirements.

-

Document Collection: Assist in gathering all required documents.

-

Application Filing: Submit the online GST registration form.

-

Verification: Track and manage any queries from GST officials.

-

GSTIN Issued: Receive your GST certificate and start invoicing.

Why Choose Invention Tax Solutions for GST Registration in Telangana?

-

10+ Years Experience in business compliance and tax registration.

-

Fast Processing – Get your GST number without delays.

-

Affordable Packages – Transparent pricing with no hidden costs.

-

End-to-End Support – From filing to post-registration compliance.

-

Expert Guidance – Avoid mistakes that lead to rejection or penalties.

Other Services We Offer

Along with GST Registration, we provide:

-

Trade License Registration in Telangana

-

Food License Registration in Telangana

-

Labour License Registration in Telangana

-

MSME Registration in Telangana

-

Trademark Registration in Telangana

(These can be internally linked to your other service pages for SEO benefits.)

Real-Life Example

A Hyderabad-based online retailer approached us for urgent GST registration to list products on Amazon. We completed the process within 3 working days, enabling them to start selling online without delays and claim Input Tax Credit from day one.

Benefits of Getting GST Registration with Us

-

Start issuing GST-compliant invoices immediately.

-

Save money through Input Tax Credit claims.

-

Build credibility with suppliers and customers.

-

Enable easy expansion to interstate and online markets.

FAQs on GST Registration Services in Telangana

-

What is the cost of GST Registration in Telangana?

Our packages start at competitive rates with no hidden charges. Contact us for details. -

How long does GST Registration take?

Typically 3–7 working days, depending on document readiness. -

Is GST Registration mandatory for online sellers?

Yes, it is compulsory for anyone selling goods/services through online platforms. -

Can I apply for GST Registration myself?

Yes, but professional help ensures accuracy and faster approval. -

What happens if I don’t register for GST when required?

You may face heavy fines, penalties, and a business ban in certain cases. -

Do I need a separate GST number for each state?

Yes, if you operate in multiple states, you need separate registrations. -

What is the GST threshold limit in Telangana?

₹40 lakhs for goods and ₹20 lakhs for services (special category states differ). -

Can I change my GST details later?

Yes, amendments can be made with GSTN approval. -

Is GST registration valid for a lifetime?

Yes, unless cancelled or surrendered. -

Do small businesses benefit from GST?

Yes, they can opt for the composition scheme and pay lower tax rates.

Call to Action

Don’t let GST compliance slow down your business growth.

📞 Call Invention Tax Solutions today or book your GST Registration online to get your GST number quickly, hassle-free, and at the best price in Telangana.