Menu

Close

- Registrations

Company Registrations

-

Proprietorship FirmProprietorship Firm

-

Partnership FirmPartnership Firm

-

PVT LTD RegistrationPVT LTD Registration

-

OPC RegistrationOPC Registration

-

LLP RegistrationLLP Registration

-

Startup RegistrationStartup Registration

-

Society RegistrationSociety Registration

-

Udyam RegistrationUdyam Registration

Govt Registrations

-

Labour LicenseLabour License

-

GHMC Trade LicenseGHMC Trade License

-

Panchayath Trade LicensePanchayath Trade License

-

ISO RegistrationISO Registration

-

IEC Code RegistrationIEC Code Registration

-

ESI RegistrationESI Registration

-

PF RegistrationPF Registration

-

- Food License

FSSAI Registrations

-

Food License RegistrationFood License Registration

-

Food State LicenseFood State License

-

Food Central LicenseFood Central License

-

- Trademark

Brand Registrations

-

TradeMark RegistrationTradeMark Registration

-

Trademark ObjectionTrademark Objection

-

- Goods & Service Tax

GST Registrations

-

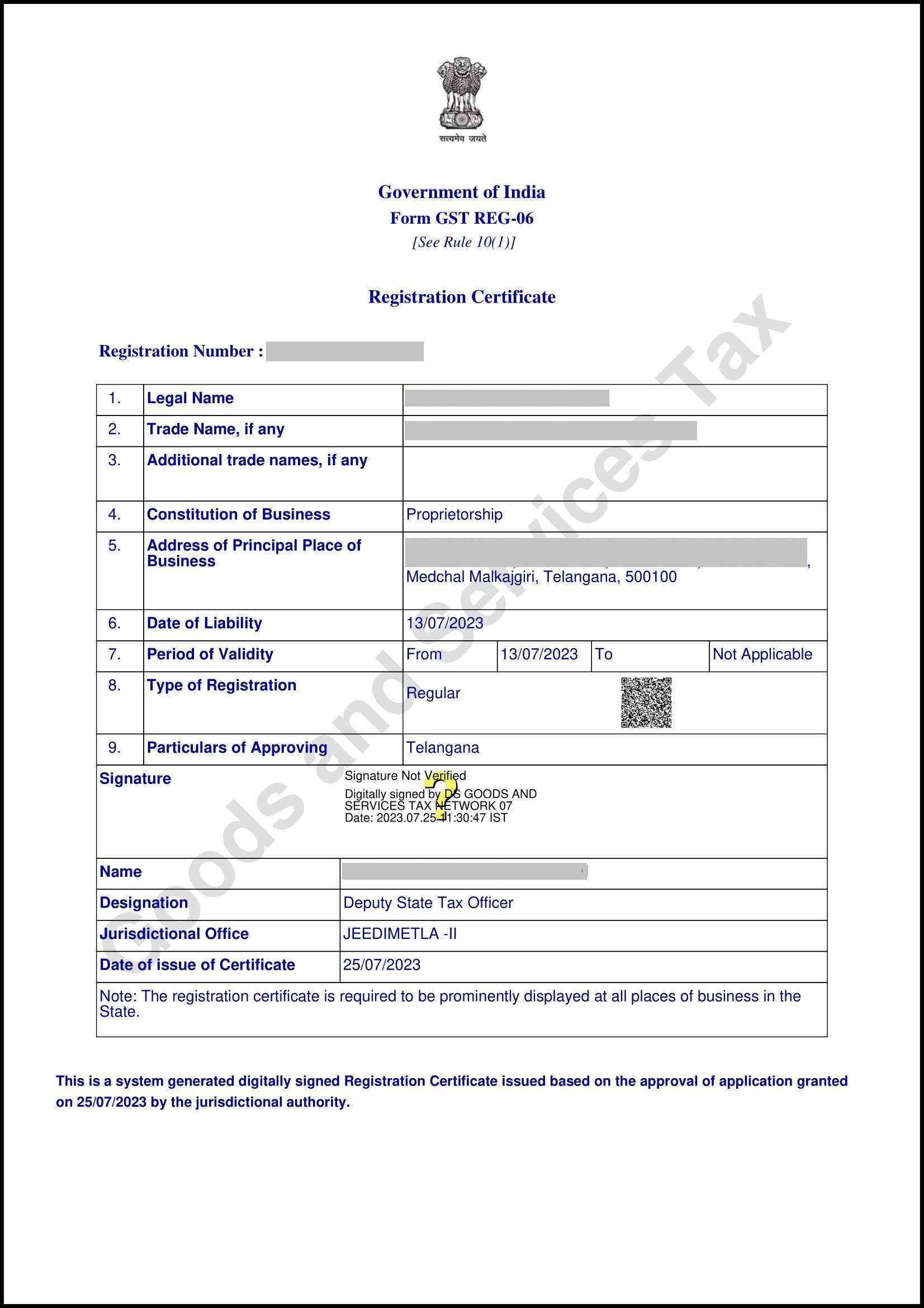

GST RegistrationGST Registration

-

GST Return FilingGST Return Filing

-

- Tax Compliances

Tax Returns Filing

-

Income Tax FilingIncome Tax Filing

-

Professional Tax RegistrationProfessional Tax Registration

-

- Our Profile

-

About UsAbout Us

-

Contact UsContact Us

-

Blog/Updates..Blog/Updates..

-

- Registrations

Company Registrations

-

Proprietorship FirmProprietorship Firm

-

Partnership FirmPartnership Firm

-

PVT LTD RegistrationPVT LTD Registration

-

OPC RegistrationOPC Registration

-

LLP RegistrationLLP Registration

-

Startup RegistrationStartup Registration

-

Society RegistrationSociety Registration

-

Udyam RegistrationUdyam Registration

Govt Registrations

-

Labour LicenseLabour License

-

GHMC Trade LicenseGHMC Trade License

-

Panchayath Trade LicensePanchayath Trade License

-

ISO RegistrationISO Registration

-

IEC Code RegistrationIEC Code Registration

-

ESI RegistrationESI Registration

-

PF RegistrationPF Registration

-

- Food License

FSSAI Registrations

-

Food License RegistrationFood License Registration

-

Food State LicenseFood State License

-

Food Central LicenseFood Central License

-

- Trademark

Brand Registrations

-

TradeMark RegistrationTradeMark Registration

-

Trademark ObjectionTrademark Objection

-

- Goods & Service Tax

GST Registrations

-

GST RegistrationGST Registration

-

GST Return FilingGST Return Filing

-

- Tax Compliances

Tax Returns Filing

-

Income Tax FilingIncome Tax Filing

-

Professional Tax RegistrationProfessional Tax Registration

-

- Our Profile

-

About UsAbout Us

-

Contact UsContact Us

-

Blog/Updates..Blog/Updates..

-