Private Limited Registration

₹20,000.00 ₹18,000.00

Discover everything you need to know about private limited registration services in Telangana — from process, documents, costs, and benefits to expert insights, FAQs, real-life examples, and actionable tips to grow your business confidently in 2025.

Private Limited Registration Services in Telangana.

Starting a business in Telangana? Registering it as a Private Limited Company is one of the smartest decisions you can make. At Invention Tax Solutions, we provide Private Limited Registration Services in Telangana that are fast, reliable, and fully compliant with the Ministry of Corporate Affairs (MCA) guidelines.

Whether you’re an entrepreneur in Hyderabad launching your first startup or a growing business in Warangal looking to formalize your operations, we handle everything—so you can focus on your ideas while we take care of the legal process.

Why Choose a Private Limited Company in Telangana?

Registering as a Private Limited Company gives you:

-

Legal Recognition – Your business becomes a separate legal entity.

-

Limited Liability – Protects your personal assets from business risks.

-

Ease of Funding – Attract investors and raise capital more easily.

-

Brand Credibility – Builds trust with customers, partners, and banks.

-

Perpetual Existence – Company continues even if ownership changes.

-

Tax Benefits – Eligible for various deductions and incentives.

Example:

A tech startup in Hyderabad registered as a Private Limited Company and secured ₹50 lakh in angel funding within six months, thanks to investor confidence in the business structure.

Who Should Register a Private Limited Company?

You should opt for Private Limited Registration if you:

-

Plan to raise funding or bring in investors.

-

Want to limit personal liability.

-

Aim for long-term scalability.

-

Operate in a competitive market where brand image matters.

-

Wish to offer employee stock options (ESOPs) in the future.

Documents Required for Private Limited Registration in Telangana

-

Identity Proof – Aadhaar/Passport/Voter ID of all directors.

-

Address Proof – Utility bill/Bank statement not older than 2 months.

-

Photographs – Passport-sized photos of all directors.

-

PAN Card – Of all directors and shareholders.

-

Proof of Registered Office – Rent agreement or property ownership papers.

-

NOC from Owner – If the office is on rented premises.

Our Private Limited Registration Process

We follow a streamlined process to make your registration smooth and hassle-free:

-

Free Consultation – Understanding your business goals and needs.

-

Name Approval – Applying for your company name through the MCA portal.

-

Digital Signature Certificate (DSC) – For all directors.

-

Director Identification Number (DIN) – Registration of directors with MCA.

-

Filing Incorporation Forms – Preparing and submitting all necessary documents.

-

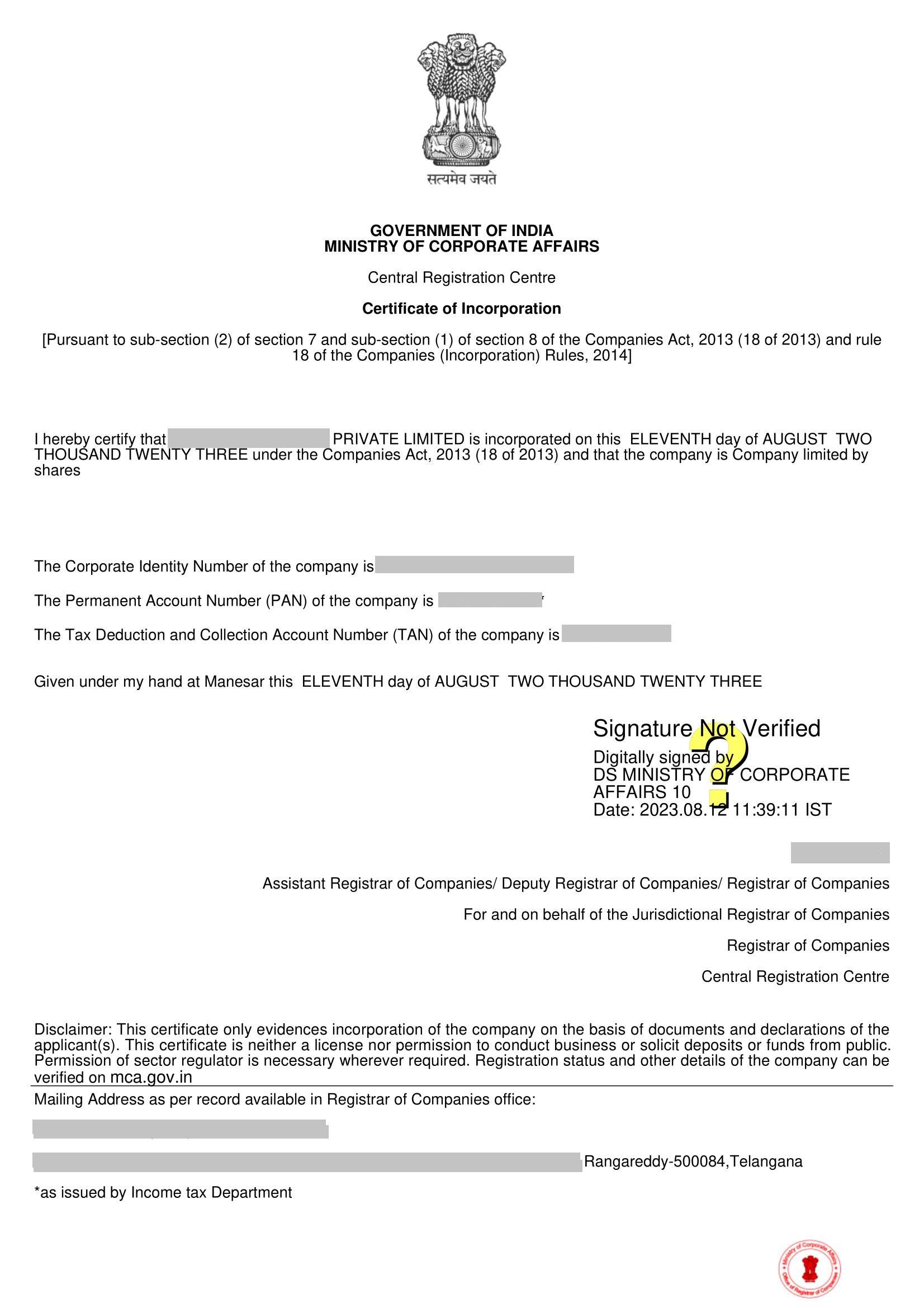

Certificate of Incorporation – Official document confirming your company’s registration.

-

Post-Registration Support – PAN, TAN, GST registration, and compliance guidance.

(We also offer GST Registration in Telangana, Trade License Registration, and Trademark Registration for complete compliance.)

Benefits of Choosing Invention Tax Solutions

-

✅ Quick Turnaround – Complete registration in the shortest time.

-

✅ Affordable Packages – Transparent pricing without hidden costs.

-

✅ Expert Support – 10+ years of experience in company registrations.

-

✅ Pan-Telangana Service – Available in Hyderabad, Warangal, Karimnagar, Nizamabad, and more.

-

✅ End-to-End Compliance – From incorporation to annual filing, we’ve got you covered.

Real-Life Client Story

Case: Two friends in Karimnagar wanted to start an e-commerce clothing brand.

Challenge: They were confused about whether to go for LLP or Private Limited structure.

Solution: We guided them on the benefits of a Private Limited Company, registered their business in 8 days, and helped them obtain GST and trademark registration.

Result: They now sell to customers across India and are negotiating with a venture capital firm for funding.

Additional Services We Offer in Telangana

-

GST Registration – Tax compliance for your new company.

-

Trade License Registration – For municipal business permissions.

-

Labour License Registration – For worker compliance.

-

MSME Registration – For subsidies and government benefits.

-

Trademark Registration – Protect your brand name and logo.

FAQs – Private Limited Registration Services in Telangana

1. How long does it take to register a Private Limited Company in Telangana?

Usually 7–10 working days, depending on name approval and documentation.

2. How many directors are required for a Private Limited Company?

A minimum of two directors are required.

3. Can I register a Private Limited Company with just one shareholder?

Yes, but there must be at least two people (can be both shareholder and director).

4. Do I need to visit any government office for registration?

No, the entire process is online through MCA.

5. Can foreign nationals be directors in a Private Limited Company?

Yes, provided they have the required identification documents.

6. Is GST mandatory for a newly registered Private Limited Company?

Not unless your turnover exceeds the threshold, but many companies opt for early GST registration.

7. What is the minimum capital requirement?

There is no minimum paid-up capital requirement now.

8. Can I convert my sole proprietorship into a Private Limited Company?

Yes, we can help with the conversion process.

9. Do I need a physical office to register?

Yes, a registered office address in Telangana is mandatory.

10. What post-registration compliances are required?

Annual returns, financial statements, and statutory meetings are mandatory.

Get Your Private Limited Company Registered Today!

Take your business to the next level with Invention Tax Solutions. Our Private Limited Registration Services in Telangana make the process simple, affordable, and completely hassle-free.

📞 Call Us Now: +91-7993132530

📩 Email: contact@inventiontaxsolutions.com

💻 Book Your Service Online