GST Registration in Telangana: Everything You Need to Know for Your Business

Are you starting a new business or expanding your existing one in Telangana? One of the most important steps you need to take is GST Registration in Telangana. For businesses whose turnover exceeds a specific threshold limit, obtaining GST Registration is mandatory. Not only does this allow you to legally collect and remit Goods and Services Tax (GST), but it also enables you to claim input tax credits, which can reduce your overall tax liability.

In this article, we will explore the importance of GST Registration, the benefits it brings to your business, and how it can simplify your tax filing process. Whether you’re a startup, an established business owner, or a brand creator in Telangana, staying compliant with GST laws is essential to running a successful business.

Why is GST Registration Important for Businesses in Telangana?

Legal Authorization to Collect and Pay GST

When you register for GST, the government grants you the legal authority to collect and pay GST on behalf of the government. Without registration, you cannot legally collect GST from your customers or remit it to the authorities. This puts your business at risk of penalties and other legal consequences.

Claim Input Tax Credits

GST Registration allows businesses to claim input tax credits (ITC) for the tax paid on purchases of goods and services. This means that if you are paying GST on the materials or services you buy, you can offset that amount against the GST you collect from your customers. This can significantly reduce your overall tax liability and improve profitability.

Comply with India’s Unified Tax System

India’s Goods and Services Tax (GST) system offers a unified tax framework that simplifies the tax process for businesses. When your business is registered, it ensures that you are in compliance with the centralized tax system and avoids the complexities of multiple state and central taxes. This makes tax filing simpler and more straightforward.

Meet the Mandatory Threshold Requirements

In India, businesses with an annual turnover exceeding the prescribed limit are required by law to register for GST. If you exceed the turnover threshold and fail to register, you may face penalties, and your business may face complications with financial transactions, including access to business loans or services from suppliers.

Enhance Your Credibility with Clients and Financial Institutions

Having GST Registration adds credibility to your business. Clients and suppliers often prefer to deal with GST-registered businesses as it signifies that your business is legitimate, compliant, and trustworthy. Moreover, financial institutions are more likely to offer business loans and other financial services to GST-registered companies.

What Are the Benefits of GST Registration?

-

Legal Authorization: GST Registration gives you the legal right to collect and pay GST, ensuring your business operates within the law.

-

Input Tax Credit: You can claim credits for GST paid on purchases, reducing your overall tax liability.

-

Simplified Tax Filing: With a unified tax system, businesses find it easier to file taxes, reducing the administrative burden.

-

Improved Credibility: Clients and suppliers trust GST-registered businesses, which can help grow your network and improve business opportunities.

-

Avoid Penalties: By complying with GST laws, you avoid hefty penalties that come with non-registration.

How to Register for GST in Telangana?

Registering for GST in Telangana is a simple process, but it requires certain documents and steps. Below is a step-by-step guide to help you through the GST registration process:

Step 1: Check Eligibility

First, check if your business exceeds the turnover limit set by the government. The current threshold limit for GST registration depends on your business type, such as whether it’s a goods-based or service-based business. If your business meets the criteria, you must proceed with the registration process.

Step 2: Prepare Required Documents

Before you start the registration, gather all the necessary documents, including:

-

PAN card of the business owner(s)

-

Address proof of the business

-

Bank account details

-

Business constitution (e.g., partnership deed, incorporation certificate)

-

Passport-size photographs of the business owners

Step 3: Apply Online

Visit the official GST portal and create a GST account. Fill in the required details about your business and upload the necessary documents. Ensure that the information is accurate, as any discrepancies can delay the registration process.

Step 4: Verification of Application

Once you submit your application, the GST authorities will verify the details and documents. If everything is in order, they will approve your application. This process usually takes a few days, but it can be quicker if all documents are submitted correctly.

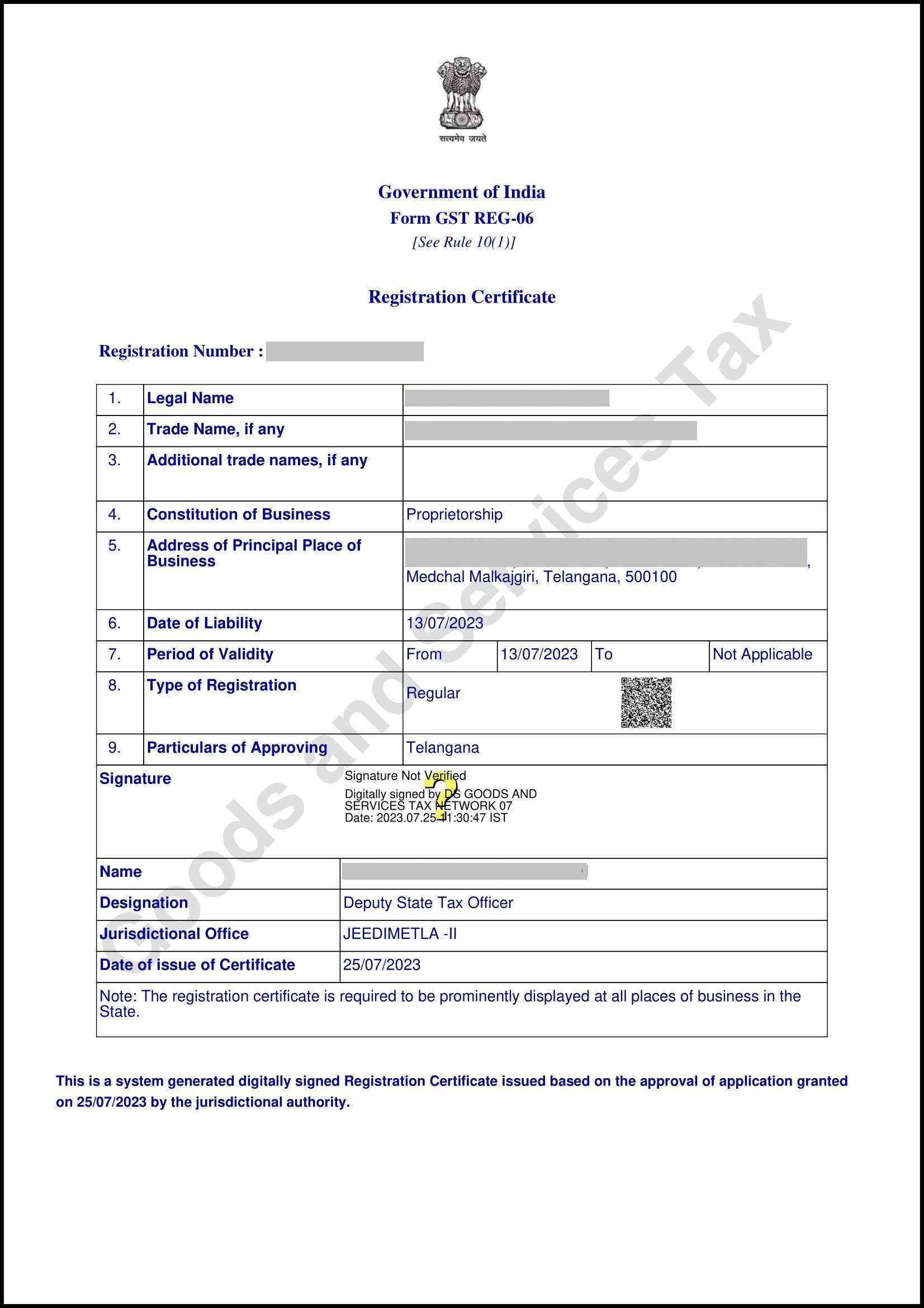

Step 5: GST Registration Certificate

Once your application is approved, you will receive your GST Registration Certificate. This certificate serves as proof of your business’s GST registration and allows you to begin legally collecting and remitting GST.

Common Challenges Faced Without GST Registration

Operating without GST Registration can lead to several challenges for businesses, especially those that exceed the threshold turnover limit. Here are some of the common issues:

-

Legal Complications: Without GST registration, your business is not legally allowed to collect GST from customers, putting your business at risk of penalties and fines.

-

Inability to Claim Input Tax Credits: Without registration, you lose the ability to offset GST on purchases, increasing your tax burden.

-

Difficulty in Accessing Financial Services: Banks and financial institutions may hesitate to offer services or loans to businesses without proper GST registration.

-

Reduced Credibility: Unregistered businesses may struggle to establish trust with clients and suppliers, limiting opportunities for growth.

Conclusion

GST Registration in Telangana is essential for businesses that wish to remain compliant with the law and operate efficiently within India’s unified tax system. The process of GST registration offers multiple benefits, including legal authorization to collect GST, the ability to claim input tax credits, and simplified tax filing. Additionally, GST registration enhances your business’s credibility and ensures that you meet all necessary legal requirements.

By registering for GST, you protect your business from penalties, improve profitability, and lay a strong foundation for growth. If you’re a business owner, startup, or brand creator in Telangana, make sure to complete your GST registration and stay tax-ready.

For expert assistance with your GST registration in Telangana, reach out to professionals who can guide you through the process and ensure that your business remains compliant.