MSME Registration in Andhra Pradesh: Complete Guide to Unlock Business Benefits

Starting and growing a small or medium enterprise in India comes with its own set of challenges. One of the most effective ways to gain government support, financial benefits, and market credibility is through MSME registration in Andhra Pradesh. Whether you’re a startup, a manufacturing unit, or a service provider, getting your business registered as an MSME (Micro, Small, and Medium Enterprise) opens doors to a variety of advantages.

In this blog, we’ll walk you through everything you need to know about MSME registration services in Andhra Pradesh—from eligibility criteria and benefits to expert tips, FAQs, and common mistakes to avoid. Let’s dive in.

What is MSME Registration?

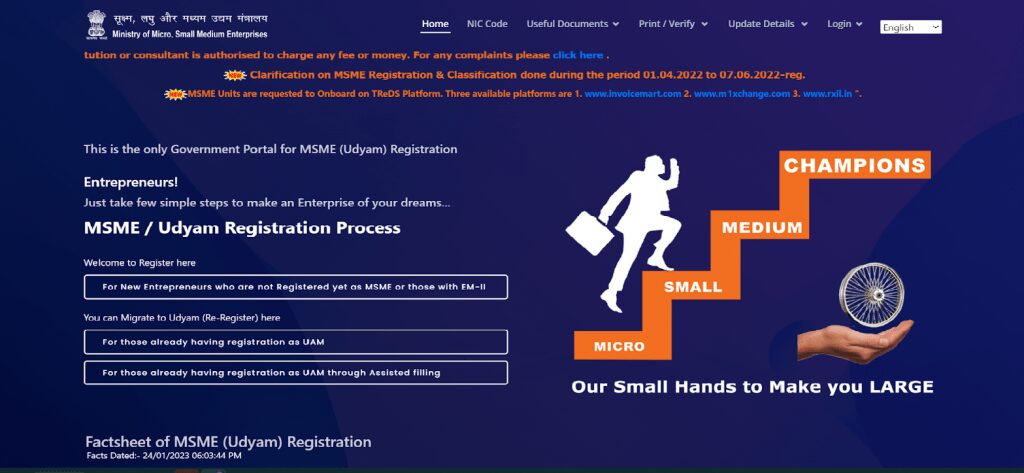

MSME registration is the process of officially classifying your business as a micro, small, or medium enterprise under the Ministry of Micro, Small and Medium Enterprises. With the implementation of Udyam Registration, the process has become completely online and paperless.

Classification of MSMEs (as per latest norms):

| Type | Investment Limit (Plant & Machinery) | Annual Turnover Limit |

|---|---|---|

| Micro | Up to Rs. 1 crore | Up to Rs. 5 crore |

| Small | Up to Rs. 10 crore | Up to Rs. 50 crore |

| Medium | Up to Rs. 50 crore | Up to Rs. 250 crore |

Why MSME Registration Matters for Andhra Pradesh Businesses

Andhra Pradesh, known for its thriving agriculture, textile, food processing, and tech sectors, is fertile ground for MSMEs. Registering under MSME in the state ensures:

Access to government schemes

Easier bank loans and subsidies

Tax exemptions and reduced compliance

Market exposure and vendor registration eligibility

Real-Life Example:

Ramesh Garments, a Vijayawada-based textile unit, registered as an MSME in 2022 and qualified for collateral-free loans under the CGTMSE scheme, allowing them to scale operations rapidly.

Step-by-Step MSME Registration Process in Andhra Pradesh

1. Visit the Udyam Registration Portal

Start by visiting udyamregistration.gov.in

2. Use Aadhaar Number

The proprietor/partner/director’s Aadhaar number is required.

3. Fill in the Business Details

Provide information such as PAN, GST number (if applicable), investment, turnover, and bank account.

4. Self-declaration Submission

No documents are needed to be uploaded. The registration is self-declared.

5. Get the Udyam Registration Certificate

Instantly receive a digital certificate with a unique Udyam number.

Documents Required (Only for Reference)

While no physical documents are needed for Udyam registration, it’s good to have the following details ready:

Aadhaar number

PAN card

GSTIN (if available)

Bank account details

Business address

Benefits of MSME Registration in Andhra Pradesh

Financial Benefits

Priority sector lending from banks

Interest rate subsidy on loans

Collateral-free loans under CGTMSE

Tax and Regulatory Benefits

Exemption from direct tax laws

Concession on electricity bills

ISO certification reimbursements

Market & Government Support

Participation in government tenders

Protection against delayed payments

Access to MSME Samadhan portal

Common Mistakes to Avoid

Providing incorrect business classification (Micro vs. Small)

Not updating Udyam registration after changes in business details

Using incorrect Aadhaar/PAN numbers

Registering multiple Udyam numbers for the same enterprise

Expert Tips for Smooth MSME Registration

Keep all business and personal details handy before starting

Double-check your Aadhaar-PAN linkage

Ensure that turnover and investment values match your latest financials

If your business is GST-registered, ensure consistent entries across portals

Use Cases: Who Should Register?

1. Startups in Vizag Tech Valley

Many early-stage startups use MSME registration to secure seed funding and participate in state incubation programs.

2. Agro-based Enterprises in Guntur and Kurnool

Get access to subsidies on machinery and fertilizers.

3. Handicraft & Textile Businesses in Chirala

Enable participation in state-supported trade expos and get tax rebates.

Latest Statistics on MSMEs in Andhra Pradesh

Over 12 lakh MSMEs registered in Andhra Pradesh as of 2024

60% growth in Udyam registrations post-2020 (Udyam Portal)

Andhra Pradesh contributes to 6.3% of India’s total MSME exports

Pros and Cons of MSME Registration

✅ Pros:

Instant registration certificate

Wide range of financial and legal benefits

Helps with creditworthiness and supplier confidence

❌ Cons:

Self-declaration errors can lead to incorrect classification

Government support schemes can be delayed in processing

Requires annual verification of turnover and investment data

Internal Links (Recommended)

Frequently Asked Questions (FAQs)

Is MSME registration mandatory in Andhra Pradesh?

No, it’s not mandatory but highly recommended for businesses seeking government support.What is the cost of MSME registration?

It is completely free when done via the Udyam portal.Is GST mandatory for MSME registration?

GST is not mandatory for Udyam registration unless your business crosses the threshold.Can I edit my Udyam registration later?

Yes, you can update your business details anytime using the Udyam portal.Is MSME registration valid for lifetime?

Yes, unless the business exceeds the defined thresholds.Can a trader apply for MSME registration?

Earlier traders were excluded, but now retail and wholesale traders are also allowed.How long does the MSME registration process take?

The digital certificate is issued instantly.Can I apply without a PAN card?

PAN is mandatory after April 2021. Aadhaar alone isn’t enough.Is there any annual renewal required?

No renewal is required, but updating your data is advised annually.Can foreign companies get MSME registration?

Only Indian entities can register under MSME in India.

Final Thoughts: Why You Shouldn’t Delay MSME Registration

Registering your business under MSME in Andhra Pradesh is no longer optional if you want to stay competitive and grow sustainably. The benefits far outweigh the minor effort it takes to register. From financial incentives to market exposure, MSME registration helps future-proof your enterprise.

Whether you’re an entrepreneur in Visakhapatnam or running a small manufacturing unit in Anantapur, this registration can be your gateway to structured growth.

✅ Ready to Register Your MSME in Andhra Pradesh?

Let our experts handle the process for you—quick, reliable, and 100% online. Avoid errors, save time, and start enjoying MSME benefits today.